Deciding whether to rent or buy a home in the UAE is a significant decision that requires careful consideration. The UAE’s real estate market is dynamic, with both opportunities and challenges for renters and buyers.

Whether you’re an expatriate considering a move or a resident contemplating a change, understanding the pros and cons of each option can help you make an informed decision.

Understanding the UAE Housing Market

Current Market Trends

The UAE’s real estate market is characterized by rapid growth and a diverse range of properties. Key cities like Dubai and Abu Dhabi are known for their luxury apartments, villas, and commercial spaces.

The real estate market in 2024 presents a dynamic landscape for both buyers and renters. While interest rates continue to fluctuate, property prices have shown signs of stabilization in many regions.

For those seeking long-term investment and a sense of ownership, buying a home can offer significant benefits, such as building equity and potential appreciation.

However, the initial down payment and ongoing mortgage payments can be substantial. Renting, on the other hand, provides flexibility and lower upfront costs, making it a viable option for individuals who may not be ready to commit to homeownership or who anticipate frequent moves.

Ultimately, the decision to buy or rent depends on personal circumstances, financial goals, and the specific market conditions in the desired location.

Recently, there has been a shift towards affordable housing and community developments, catering to a broader audience.

Key Cities and Regions

Dubai and Abu Dhabi are the main hubs of the UAE’s real estate market. Dubai offers a mix of high-end and affordable properties, while Abu Dhabi is known for its luxury living and stable market.

Other regions like Sharjah and Ras Al Khaimah are also becoming popular due to their affordability and proximity to key business areas.

The UAE’s real estate market, particularly in major cities like Dubai and Abu Dhabi, has witnessed significant growth and development in recent years.

While Dubai remains a global hub for real estate investment, offering a diverse range of properties from luxury apartments to villas, Abu Dhabi has seen a surge in demand for residential and commercial spaces, driven by economic growth and infrastructure development.

Other key cities like Sharjah and Ajman also present attractive opportunities for both buyers and renters, with a more affordable cost of living compared to Dubai and Abu Dhabi.

However, it’s important to consider factors such as location, amenities, and future development plans when making a decision about buying or renting in any of these cities.

Renting a Home in the UAE

Pros of Renting

Flexibility: Renting allows for easier relocation, especially for those with short-term stays or uncertain job prospects.

Lower upfront costs: Renting typically requires a smaller initial investment compared to buying, making it a more accessible option for those with limited funds.

Reduced maintenance responsibilities: Landlords are generally responsible for property maintenance and repairs, freeing tenants from these burdens.

Market fluctuation protection: Renting can be a safer option during times of market uncertainty, as tenants are not directly affected by property value fluctuations.

Cons of Renting

Renting in the UAE, while offering flexibility and lower upfront costs, also presents certain drawbacks. One significant disadvantage is the lack of ownership and equity buildup. Unlike homeowners, renters do not benefit from property appreciation over time.

Additionally, renters may face limitations in terms of customization and renovations, as landlords often have restrictions on property modifications. Furthermore, rental agreements may include clauses that limit the length of tenancy or require advance notice for renewal, potentially leading to uncertainty and inconvenience.

- No Equity Building: Rent payments do not contribute to building equity, meaning there’s no return on investment.

- Limited Control: Renters have limited control over property modifications and must adhere to the terms set by the landlord.

- Potential Rent Increases: Rent prices can increase over time, impacting your long-term budget.

Buying a Home in the UAE

Pros of Buying

Buying a property in the UAE offers several long-term benefits. One of the most significant advantages is building equity over time. As property values appreciate, homeowners can see their net worth increase.

Additionally, owning a property provides a sense of stability and security, as well as the freedom to customize and renovate to personal preferences. Furthermore, homeownership can be a lucrative investment, with potential rental income and capital gains.

- Equity Building: Purchasing a property allows you to build equity over time, which can be a valuable asset.

- Stability: Homeownership offers long-term stability and the freedom to modify your property as you see fit.

- Investment Potential: Real estate in the UAE can be a profitable investment, especially in high-demand areas like Dubai.

Cons of Buying

Buying a property in the UAE comes with significant financial commitments. Prospective homeowners need to save for a substantial down payment and be prepared for ongoing mortgage payments, property taxes, and maintenance costs.

Additionally, the real estate market can be subject to fluctuations, potentially impacting property values and rental yields. Furthermore, buying a property involves long-term commitment and can limit flexibility, especially for those who may need to relocate frequently.

- High Initial Costs: Buying a home requires a significant upfront investment, including a down payment, registration fees, and other costs.

- Market Risk: Property values can fluctuate, impacting the value of your investment.

- Maintenance Responsibilities: Homeowners are responsible for maintenance and repair costs, which can add up over time.

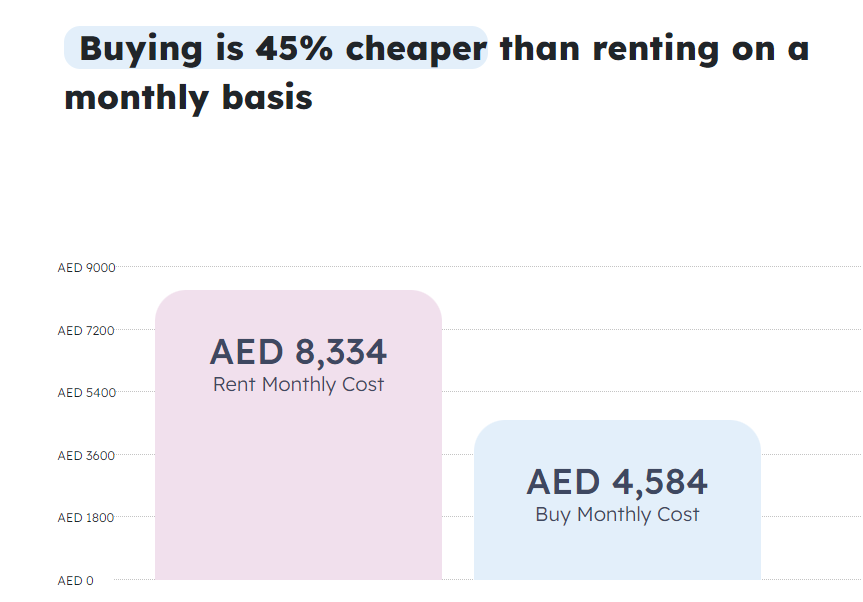

Cost Comparison

Initial Costs

Renting typically involves paying a security deposit and the first few months’ rent upfront. Buying, on the other hand, requires a substantial down payment, registration fees, and possibly a mortgage arrangement fee.

Buying a property in the UAE involves several initial costs. Prospective homeowners need to save for a substantial down payment, which typically ranges from 20% to 25% of the property’s purchase price.

Additionally, there are various fees associated with the buying process, including agency fees, registration fees, and mortgage processing fees. These costs can vary depending on the property’s location, size, and specific terms of the transaction.

Long-Term Costs

Over time, renting may be more affordable if property prices increase significantly. However, buying can be more cost-effective in the long run, especially if you plan to stay in the UAE for several years.

Once you’ve purchased a property in the UAE, there are ongoing costs to consider. Mortgage payments are a significant recurring expense, along with property taxes, which are typically calculated based on the property’s assessed value.

Additionally, homeowners are responsible for maintenance and upkeep, including repairs, renovations, and utility bills. These costs can vary depending on the property’s size, age, and location.

Mortgage Rates and Options

Mortgage rates in the UAE vary based on the lender and the property type. It’s essential to shop around and compare rates to find the best deal. Fixed and variable-rate mortgages are available, each with its own set of advantages and risks.

The UAE offers a range of mortgage options to suit different needs and financial situations. Mortgage rates are generally competitive, with interest rates fluctuating based on market conditions.

Banks and financial institutions provide various mortgage products, including conventional mortgages, Islamic finance mortgages, and government-backed schemes.

The specific terms and conditions, such as interest rates, repayment periods, and eligibility criteria, can vary depending on the lender and the borrower’s profile. It’s advisable to compare offers from multiple lenders to find the most suitable mortgage option.

Legal Considerations

Renting Regulations

Renting in the UAE is generally straightforward, with clear regulations governing tenant and landlord rights. However, it’s essential to understand your lease terms, including renewal conditions and potential rent increases.

Property Ownership Laws

For buyers, understanding property ownership laws is crucial. In designated freehold areas, expatriates can own property, but it’s important to be aware of any restrictions and the legal process involved in purchasing a home.

Lifestyle Factors

Duration of Stay in the UAE

If you plan to stay in the UAE for a short period, renting might be more practical. However, if you’re considering a long-term stay, buying could be a better investment.

When deciding whether to buy or rent a property in the UAE, it’s essential to consider your lifestyle and preferences. Factors such as proximity to your workplace, schools, and amenities like shopping malls, restaurants, and recreational facilities should be taken into account.

If you prioritize a family-friendly environment, you may want to consider areas with good schools and parks. For those seeking a vibrant social scene, proximity to entertainment districts and nightlife options might be a priority.

Additionally, consider your preferred living environment, whether it’s a bustling city center, a quiet suburban neighborhood, or a beachfront location.

Flexibility vs. Stability

Renting offers flexibility, allowing you to move easily if your circumstances change. Buying, on the other hand, provides stability and a sense of permanence.

The decision to buy or rent a property in the UAE often involves weighing the trade-off between flexibility and stability. Renting offers greater flexibility, allowing individuals to relocate easily and avoid long-term commitments.

However, buying provides a sense of stability and the potential for long-term financial benefits. Ultimately, the choice depends on individual circumstances, such as job security, anticipated length of stay, and financial goals.

Family Considerations

For families, buying might offer more benefits, such as stability, the ability to personalize your space, and potentially better long-term financial planning.

When considering buying or renting a property in the UAE for a family, several factors should be taken into account. Schools and educational institutions are a top priority, especially for families with children.

The proximity to quality schools and universities can significantly impact the overall family experience.

Additionally, access to healthcare facilities, parks, and recreational areas is crucial for a comfortable and fulfilling family life. It’s also important to consider the safety and security of the neighborhood, as well as the availability of community facilities and social activities.

Investment Perspective

Real Estate as an Investment

Real estate in the UAE has the potential for high returns, especially in growing areas. Whether you’re looking to live in the property or rent it out, buying can be a sound investment strategy.

Potential Returns

The UAE’s real estate market has historically offered good returns, particularly in prime locations. However, like all investments, there are risks, and it’s essential to consider market conditions and future trends.

Economic Factors

Impact of the Economy on Property Prices

The UAE’s economy, influenced by factors like oil prices and global economic conditions, directly impacts property prices. During economic downturns, property values may decrease, while in times of growth, they tend to rise.

Inflation and Interest Rates

Inflation and interest rates can affect both renting and buying. Higher interest rates make mortgages more expensive, while inflation can increase rent prices.

Expat Considerations

Residency and Visa Implications

Owning property in the UAE can offer residency visa benefits, making it an attractive option for expatriates. However, it’s essential to understand the requirements and regulations involved.

Community and Expatriate Preferences

Expat communities in the UAE often have preferred areas where renting or buying might be more common. Understanding these preferences can help you make a more informed decision.

Market Predictions

Future Trends in the UAE Property Market

Experts predict that the UAE’s property market will continue to grow, with increasing demand for affordable housing and sustainable developments. However, market conditions can change, so it’s essential to stay informed.

Expert Opinions

Real estate experts often advise on whether it’s better to calculate rent or buy based on market conditions, personal circumstances, and financial goals. Consulting with a real estate professional can provide valuable insights.

Making the Decision

Factors to Weigh Before Deciding

Before deciding whether to rent or buy, consider your financial situation, length of stay, market conditions, and personal preferences. Both options have their advantages and drawbacks.

Personal Financial Assessment

Conduct a personal financial assessment to understand what you can afford, including down payments, mortgage payments, or rent. This will help you make a more informed decision.

Deciding whether to rent or buy a home in the UAE depends on various factors, including your financial situation, lifestyle, and long-term plans. Both options offer distinct advantages, and the right choice will depend on your unique circumstances. By carefully considering the pros and cons of each option, you can make a decision that best suits your needs.

FAQs

What are the tax implications of buying property in the UAE?

The UAE currently does not impose property taxes, making it an attractive destination for real estate investment.

Can expatriates buy property in the UAE?

Yes, expatriates can buy property in designated freehold areas within the UAE.

How does renting affect my residency status?

Renting does not impact your residency status. However, owning property may offer additional visa benefits.

What are the hidden costs of buying a home in the UAE?

Hidden costs can include maintenance fees, service charges, and potential market fluctuations that could affect property value.

How can I determine the best choice for my situation?

Consider factors like your financial stability, long-term plans, and market conditions. Consulting with a real estate advisor can also help you make an informed decision.