Investing in rental property in the UAE can be lucrative, but understanding how to calculate the Return on Investment (ROI) is crucial to ensure profitability. The UAE’s dynamic real estate market offers numerous opportunities, but without a clear grasp of ROI, investors may struggle to make informed decisions.

Key Takeaways

- Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment.

- To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost.

- If you have a mortgage, you’ll need to factor in your downpayment and mortgage payment.

- Other variables can affect your ROI including repair and maintenance costs, as well as your regular expenses.

” To calculate the return on investment (ROI) for this studio apartment, we divide the annual income by the initial personal expenses of the investor and then multiply the result by 100 to get a percentage: AED 41,000 ÷ AED 657,000 = 0.062 x 100 = 6.2% per annum. “

What is ROI (Return on Investment)?

ROI, or Return on Investment, is a key metric that helps investors assess the profitability of an investment. It’s calculated by dividing the net profit from the investment by the total amount invested. ROI is essential for real estate investors because it provides a clear picture of how well their money is working for them.

Definition and Basic Formula

The basic formula for ROI is:

ROI = (Net Profit / Total Investment) x 100

This formula helps investors evaluate the efficiency of their investment and compare it with other opportunities.

Why ROI is Crucial for Real Estate Investors

In real estate, ROI is especially important because it helps investors understand the potential returns on a property. This insight is vital for making informed decisions about whether to purchase, hold, or sell a property.

Key Factors Affecting ROI in the UAE Rental Market

Several factors can influence the ROI of a rental property in the UAE, and understanding these can help investors maximize their returns.

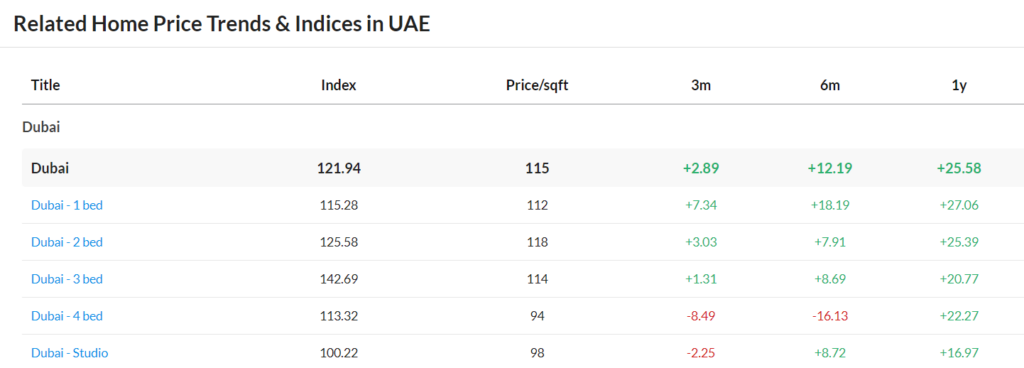

Location

Location is perhaps the most significant factor in determining ROI. Properties in prime areas like Dubai Marina or Downtown Dubai generally offer higher rental yields, while those in emerging areas might offer lower initial returns but greater potential for capital appreciation.

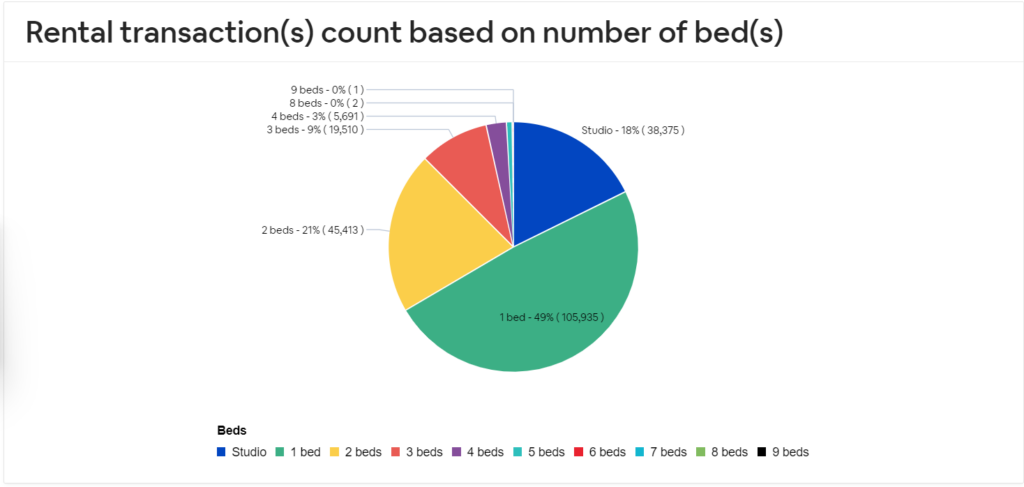

Property Type and Size

Different types of properties (e.g., apartments, villas, townhouses) and their sizes can have varying impacts on ROI. Larger properties may command higher rents but also come with higher maintenance costs.

Rental Demand and Vacancy Rates

High demand and low vacancy rates are indicators of a healthy rental market, which can positively affect ROI. Conversely, high vacancy rates can eat into profits and reduce ROI.

Property Management Costs

Effective property management is crucial for maintaining high ROI. Costs associated with property management, such as maintenance, repairs, and tenant acquisition, can significantly impact net profits.

Step-by-Step Guide to Calculating ROI on a Rental Property

Let’s break down the process of calculating ROI on a rental property in the UAE into manageable steps.

Step 1: Determine the Gross Rental Income

The first step in calculating ROI is to determine the gross rental income, which is the total income generated from renting out the property before any expenses are deducted.

How to Estimate Monthly Rental Income

To estimate the monthly rental income, research similar properties in the area to see what they are renting for. Websites like Property Finder or Bayut can be useful resources for this.

Annual Gross Rental Income Calculation

Once you’ve estimated the monthly rental income, multiply it by 12 to get the annual gross rental income. This figure will be used in subsequent calculations.

Step 2: Calculate Operating Expenses

Operating expenses are the costs associated with running the rental property. These must be deducted from the gross rental income to determine the net operating income.

Common Operating Expenses in the UAE

Operating expenses in the UAE may include:

- Maintenance and repairs

- Property management fees

- Insurance

- Utilities (if covered by the landlord)

- Property taxes (though often minimal or non-existent in the UAE)

Step 3: Determine Net Operating Income (NOI)

Net Operating Income (NOI) is the income left after operating expenses are deducted from the gross rental income.

Formula for NOI

NOI = Gross Rental Income – Operating Expenses

NOI is a critical figure as it directly impacts the ROI calculation.

Importance of NOI in ROI Calculation

A high NOI indicates that the property is generating substantial income after covering its costs, which is essential for a strong ROI.

Step 4: Calculate the Total Investment

The total investment includes all the costs involved in acquiring and preparing the property for rental.

Initial Purchase Price

The initial purchase price of the property is the largest component of the total investment. It’s essential to include any down payment and mortgage costs here.

Additional Costs (Renovations, Closing Fees, etc.)

Don’t forget to account for additional costs such as renovations, legal fees, and closing costs, which can significantly add to the total investment.

Step 5: Calculate the ROI

Finally, calculate the ROI using the formula:

ROI = (NOI / Total Investment) x 100

Example Calculation of ROI for a UAE Rental Property

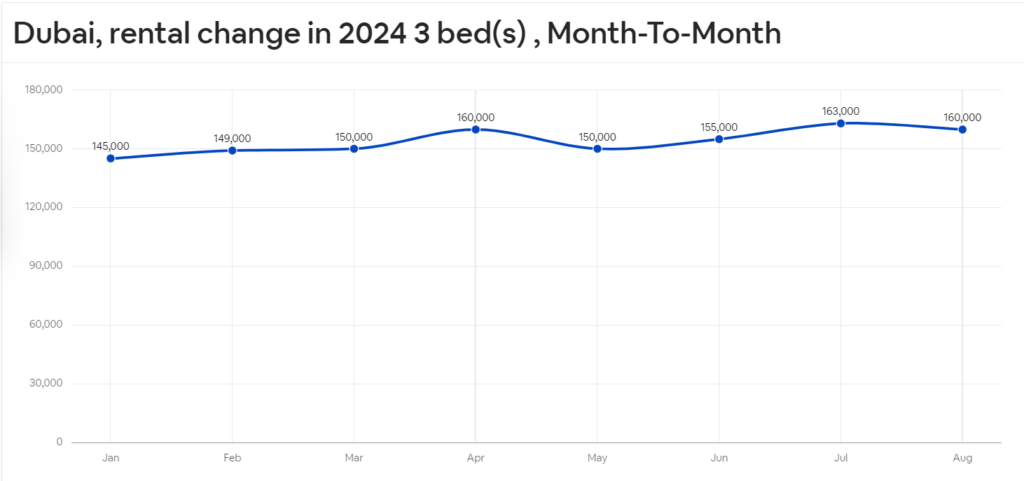

Let’s say you purchase a property in Dubai for AED 2 million, and the annual gross rental income is AED 150,000. After deducting AED 30,000 in operating expenses, your NOI is AED 120,000. If your total investment (including the purchase price and additional costs) is AED 2.2 million, the ROI would be:

ROI = (120,000 / 2,200,000) x 100 = 5.45%

Factors That Can Improve ROI

There are several strategies investors can use to improve the ROI of their rental properties.

Renovations and Upgrades

Upgrading the property with modern amenities or renovating outdated features can increase its rental value, thereby boosting ROI.

Effective Property Management

Hiring a reliable property management company can reduce vacancy rates and ensure that the property is well-maintained, both of which can enhance ROI.

Strategic Location Choices

Investing in areas with strong growth potential or in properties near key amenities (like schools, shopping centers, and public transport) can lead to higher rental demand and, consequently, a better ROI.

Challenges in Calculating ROI for UAE Rental Properties

While calculating ROI is crucial, there are challenges that investors may face in the UAE market.

Market Fluctuations

The real estate market in the UAE can be volatile, with property values and rental rates subject to change due to economic conditions, making ROI calculations more complex.

Unexpected Expenses

Unexpected costs, such as emergency repairs or legal fees, can arise and impact the accuracy of your ROI calculation.

Legal and Regulatory Considerations

Understanding the legal landscape is essential, as regulations concerning rent increases, tenant rights, and property taxes can affect ROI.

The Role of Leverage in ROI Calculation

Leverage, or using borrowed funds to finance a property purchase, can significantly impact ROI.

Using Mortgages to Increase ROI

By financing a portion of the property with a mortgage, investors can potentially increase their ROI, as they are earning returns on money that isn’t entirely their own.

Risks and Rewards of Leverage

Leverage can amplify returns, but it also comes with increased risk. If property values decline or rental income decreases, the burden of mortgage payments can negatively affect your ROI. It’s essential to weigh the potential rewards against the risks before opting for leverage.

ROI vs. Other Metrics

While ROI is a critical metric, it’s not the only one investors should consider when evaluating the profitability of a rental property. Other metrics can provide additional insights into the property’s performance.

Cash Flow

Cash flow measures the amount of money left after all expenses, including mortgage payments, have been paid. Positive cash flow is crucial for sustaining the investment, especially in the long term.

Cap Rate

The capitalization rate, or cap rate, is another important metric. It is calculated by dividing the NOI by the property’s purchase price. The cap rate provides insight into the potential return on investment without considering the effects of financing.

Yield

Yield measures the annual return on investment based on the rental income and the property’s value. It helps investors assess the property’s income-generating potential relative to its current market value.

Real-Life Examples of ROI on Rental Properties in the UAE

To provide a clearer picture of how ROI works in practice, let’s look at two real-life examples of rental properties in the UAE.

As an example, let’s walk through a comprehensive ROI calculation for a fully finished, furnished, and equipped 51 sq.m. studio apartment with a panoramic view in The Address, a five-star apartment hotel located in Dubai Marina, adjacent to the Dubai Marina Mall. The property is priced at AED 1,350,000 ($367,600). To this amount, add the transaction costs:

- Payment to the Dubai Land Department (DLD) — 4% of the property cost, which is AED 54,000 ($14,700),

- NOC (no objection certificate) — estimated AED 3,000 ($816),

- Land fee — AED 430 ($117),

- Registration fee — AED 4,000 ($1,088) + 5% VAT, total AED 4,200 ($1,143),

- Real estate agency commission — 2% of the property cost, which is AED 27,000 ($7,300).

Total transaction costs: AED 88,630 ($24,080).

Total investment: AED 1,350,000 + AED 88,630 = AED 1,438,630. Let us round it up to AED 1,439,000 ($391,800).

Income

A studio apartment of this kind can be leased for an annual average of AED 107,000. In this scenario, the property’s payback period would be 13.5 years (calculated as 1,439,000 ÷ 107,000).

You don’t necessarily have to wait for the entire payback period. For instance, you can choose to sell this studio apartment within five years.

Taking into account the price trends observed over the past five years (with a growth of +11.3% from 2017 to 2022), it’s reasonable to project a 10% increase in the property’s value, resulting in a resale price of AED 1,485,000 ($404,300).

In this case, the ROI calculation is as follows:

- Indicator A. Total income over five years of ownership: AED 1,485,000 ($404,300) + (AED 107,000 x 5) = AED 2,020,000 ($550,000).

- Indicator B. Total investment: AED 1,439,000 ($392,000).

- The ROI is calculated according to the above mentioned formula: (A – B) ÷ B = 0.4

We can calculate the total ROI by multiplying 0.4 by 100, which results in a total ROI of 40% over five years, equivalent to 8% per annum. It’s important to note that the ROI might be slightly lower in case of unforeseen circumstances.

For instance, if the lease agreement expires, and the tenant decides not to renew it, finding a new tenant immediately can be challenging. Additionally, unexpected repairs or equipment replacements may be necessary, which could impact the ROI.

Conversely, achieving a higher ROI is possible by securing a higher rental rate for the studio apartment. To do this, it’s advisable to prioritize short-term leases over long-term ones. Additionally, if property prices in Dubai Marina experience a more significant increase, say 15% instead of 10%, the ROI for five years would reach 45%, equating to 9% per annum.

Calculating the ROI on a rental property in the UAE is an essential step for any real estate investor. It provides a clear understanding of the property’s profitability and helps in making informed decisions.

By following the steps outlined in this guide, investors can accurately calculate their ROI and take the necessary steps to maximize their returns.

Whether through effective property management, strategic location choices, or smart use of leverage, there are numerous ways to improve ROI and achieve financial success in the UAE’s rental market.

FAQs

What is a good ROI for a rental property in the UAE?

A good ROI for a rental property in the UAE typically ranges between 5% and 8%. However, this can vary depending on the property’s location, type, and market conditions.

How often should I calculate the ROI on my rental property?

It’s advisable to calculate the ROI annually to ensure that your investment remains profitable and to identify any changes in the property’s financial performance.

Can I improve my ROI by refinancing my mortgage?

Yes, refinancing your mortgage to secure a lower interest rate can reduce your monthly payments, thereby increasing your ROI. However, it’s important to consider the costs associated with refinancing.

Is ROI the only metric I should consider when investing in rental properties?

No, while ROI is crucial, other metrics like cash flow, cap rate, and yield are also important for a comprehensive assessment of a rental property’s performance.

How does the UAE’s rental market compare to other countries?

The UAE’s rental market is unique due to its tax-free income, high demand in key areas, and significant expatriate population. These factors can lead to higher ROIs compared to some other countries, but they also require careful market analysis and management.