The United Arab Emirates (UAE) has emerged as a global investment hub, offering lucrative opportunities for foreign investors.

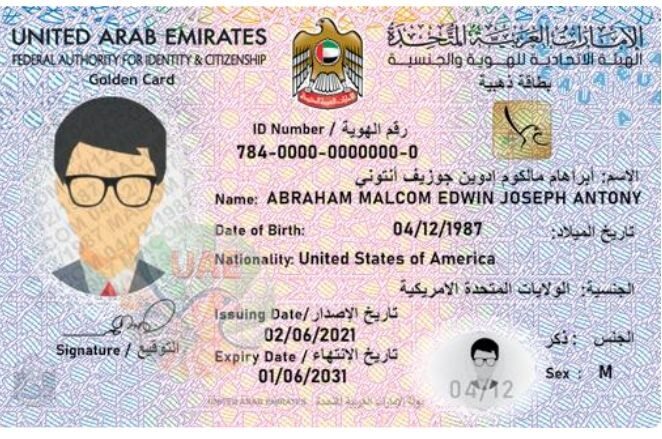

One of the most attractive incentives is the Golden Visa, a long-term residency permit granted to individuals who meet specific criteria, including property investment.

The UAE Golden Visa is a long-term residence visa that is granted to foreign investors, entrepreneurs, scientists, qualified professionals, and exceptional talents.

It offers several benefits, including the ability to live, work, and study in the UAE without any restrictions. The Golden Visa Dubai, UAE is valid for 5 or 10 years and can be renewed.

This blog delves into the rules and laws governing Golden Visas obtained through property investment in the UAE.

While the UAE offers a relatively streamlined process for obtaining a Golden Visa through property investment, it’s crucial to understand the specific laws and regulations governing this process.

Understanding the Golden Visa

The Golden Visa is a residency permit that offers several benefits, including:

- Long-term residency: Typically valid for 10 years, it provides an extended stay in the UAE.

- Family sponsorship: Eligible visa holders can sponsor their spouses and children.

- Visa-free travel: Enjoy visa-free access to numerous countries.

- Work and business permits: Flexibility to work or start businesses without a local sponsor.

Ways To Obtain A UAE Golden Visa – Multiple Pathways To Acquire

Here are some of the primary categories:

Investment

- Property Investment: Owning a property valued at AED 2 million or more.

- Investment Funds: Investing at least AED 2 million in a UAE-based investment fund.

- Business Investment: Injecting at least AED 500,000 into a new company or purchasing an existing company with a minimum valuation of AED 500,000.

Talent and Skills

- Scientists and Specialists: Possessing advanced degrees or exceptional skills in specific fields.

- Outstanding Students: Graduating from top universities with a GPA of 3.5 or higher.

- Exceptional Talent: Individuals with remarkable abilities in various fields such as culture, arts, sports, or technology.

Entrepreneurship

Entrepreneurs: Owning an innovative startup valued at AED 500,000 or participating in an incubator program.

Other Categories

- Real Estate Brokers: Achieving sales of AED 1 billion within three years.

- Doctors and Specialists: Holding a PhD or specialized medical degree.

- Investors in Small and Medium Enterprises: Investing in SMEs as per specific criteria.

It’s essential to note that the specific requirements and eligibility criteria might vary depending on the emirate.

Key Legal and Regulatory Framework

Dubai govt offers a service that allows the real estate investor owning a property the purchase value of which is equal to or more than 2 million AED at the time of purchase, to apply for a 10-year renewable residence permit. The husband or wife, children, and parents can be sponsored.

The benefits of obtaining a golden visa include residency, education, healthcare, tax benefits, and investment rewards. Downsides to a golden visa include investment risk, political instability, and tax implications, among others.

Federal Law No. 6 of 2018 on Entry and Residence of Foreigners:

This is the primary legislation governing residency in the UAE. It outlines the general framework for visas and residency permits, including Golden Visas.

Emirate-Specific Regulations:

Each emirate in the UAE has its own laws and regulations related to property ownership, investment, and residency. While the core principles of the Golden Visa program are consistent across the emirates, there may be variations in eligibility criteria, application procedures, and fees.

Real Estate Regulatory Authority (RERA):

This government body oversees the real estate sector in each emirate. It regulates property transactions, valuation, and dispute resolution.

Department of Land and Property:

This department is responsible for registration and issuing property certificates, essential documents for Golden Visa applications.

Gold Visa Considerations By Property Investments

Property Ownership:

Freehold ownership is available in specific designated areas, allowing foreigners complete ownership of the property.

Leasehold ownership is more common, granting long-term lease rights. The terms and conditions of the lease agreement are crucial.

Property Valuation:

Properties must meet the minimum valuation criteria to qualify for a Golden Visa.

Authorized valuers conduct valuations, and the process must comply with RERA regulations.

Mortgage and Financing:

Properties with mortgages may be eligible for Golden Visas, but specific conditions and documentation requirements apply.

Lenders often require a no-objection certificate to proceed with the visa application.

Tax Implications:

While the UAE currently has no personal income tax, it’s essential to be aware of other potential tax implications, such as property taxes and value-added tax (VAT).

Exit Permits and Travel Restrictions:

While Golden Visa holders enjoy greater freedom of movement, there might be certain exit permit requirements or travel restrictions, especially for children.

Importance of Legal Counsel

Given the complexities of property investment and immigration laws, it is highly recommended to seek legal counsel from a qualified attorney specializing in UAE real estate and immigration law. A legal expert can:

- Assist in property due diligence and valuation.

- Advise on the most suitable property type and location.

- Prepare and submit the necessary documentation for the Golden Visa application.

- Represent the applicant in dealing with government authorities.

- Provide guidance on post-visa issuance matters, such as property management and tax compliance.

By carefully considering these legal and regulatory aspects, investors can increase their chances of a successful Golden Visa application and enjoy the benefits of long-term residency in the UAE.

Process of Obtaining a Golden Visa

Confirmation of Property Ownership: a letter from the land department of the respective emirate confirming ownership of one or more properties valued at no less than AED2 million ($545,000).

Loan Procurement: Alternatively, investors can acquire a property through a loan from specific local banks endorsed by the competent local entity.

The process for obtaining a Golden Visa through property investment generally involves the following steps:

- Property purchase: Acquire a property in the UAE meeting the value requirement.

- Document preparation: Gather necessary documents, including passport, property title deed, and financial statements.

- Application submission: Submit the application to the relevant government authority in the emirate where the property is located.

- Visa approval: Await the approval of your Golden Visa application.

- Visa issuance: Upon approval, collect your Golden Visa.

Important Considerations

- Property valuation: Ensure the property’s valuation meets the required amount.

- Property location: Consider the property’s location and potential appreciation.

- Legal advice: Seek professional guidance to understand the legal implications of property ownership and visa acquisition.

- Emirate-specific rules: Be aware of potential variations in rules and regulations across different emirates.

The Golden Visa through property investment offers a compelling opportunity to secure long-term residency in the UAE. By understanding the eligibility criteria, process, and important considerations, you can navigate the path to obtaining this prestigious visa.